Any advertisers running activity through Facebook Ads Manager will likely be intimately familiar with the host of metrics available for dissecting and evaluating campaign performance. But what’s often missing from this detailed data is the ‘why?’.

‘Why?’ is an incredibly important question, inextricably linked to efficiently improving performance over time. Understanding why something is or isn’t working helps us define what to do next. This is where Facebook Delivery Insights can be much more helpful.

What is Facebook Delivery Insights?

Delivery Insights is a dashboard that can help you better understand the performance of your ad sets. It shows you detailed metrics about your ad delivery, auction overlap, audience saturation, and bid competition.

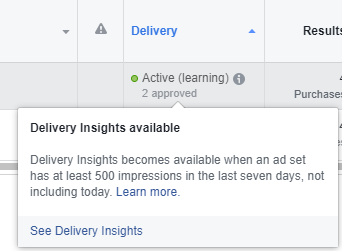

For delivery insights to appear, your ad set will need to have been running long enough to collect enough data - Facebook advises at least five consecutive days and a minimum of 500 impressions, but depending on budget you may be out of this learning phase quicker.

When available, you can access your data by hovering over the “Delivery” column at the ad set level and clicking the ‘See Delivery Insights’ link.

You can view all data within the dashboard but also export everything for your own reporting. At the moment only data from the last 7, 14 and 28 days is available.

Below we’ve focused on two of the most overlooked available metrics in delivery insights; first-time impression ratio and auction competition.

First-Time Impression Ratio

The first-time impression ratio metric, found under the audience saturation tab, is the percentage of your daily impressions that came from people seeing your ad for the first time.

This is an incredibly useful measure for audience saturation, particularly if you are using CRM data or lookalikes of your CRM data as your audience. If your percentage is low, it means most of your audience on any given day have already seen that ad (and could be getting bored of it).

The graph below show the first-time impression ratio over time for an email list audience. We can see the percentage is steadily decreasing, despite a refresh of the email data. While this is ok in the short term - as we want a frequency greater than one to drive an action - there will come a point of diminishing returns.

The same goes for lookalike audiences created with this data - these are also ‘fixed’, and so worth keeping an eye on. Where possible, use lookalikes based off the Facebook Pixel as these will continuously refresh and reduce audience saturation.

Auction Competition

Auction Competition measures how much competition in the auction has changed on a given day, relative to the competitiveness of your own bid. The competitive bid is the minimum bid you would have needed to win the auctions that were just out of your reach.

For example, if auction competition is 15.5% more competitive, this means that the competitive bid was 15.5% higher than the average for the time range selected. This change is considered significant if the auction is at least 20% more competitive.

The chart below is taken from a campaign using the ‘lowest cost’ bidding strategy. We’d expect to see fluctuations in this across the month - the orange area is anything over 20% more competitive and considered significant.

If you’re using lowest cost, there’s not a whole lot of actionable insight to derive here. However, if you’re also using a bid cap or target CPA, this will be crucial.

For example if you’re using a bid cap and your auction competition is consistently more than 20% more competitive, it means your bid cap is too restrictive and should be raised.

If you'd like to talk in greater depth about Facebook and paid social to better understand how it can drive your business objectives, please don't hesitate to get in touch with Steph Iles on 01225 58 38 38 or email hello@search-star.co.uk.